Earning

How to Negotiate a Salary | A Guide for Newcomers

Earning

Pay Deductions in Canada | Your Net Pay & Gross Pay

Special call to action text for shoutouts or promotions. Call to action link text

Written By

Corinna Frattini

Mar 18, 2024

•Earning

It’s smart to file an income tax return in Canada if you arrived in 2023. If you became a permanent resident and lived in Canada, even for a short period, filing your first income tax return with the Canada Revenue Agency (CRA) can provide financial benefits. If you didn’t earn income in Canada in 2023, filing a return allows you to apply for important benefits. Also, the government can’t pay the Goods and Services Tax (GST), Harmonized Sales Tax (HST), or Canada Child Benefit (CCB) you may be eligible for without you filing a tax return. In other words, you will have to file an income tax return if you:

While filing taxes in Canada for the first time may seem overwhelming, there are resources to help you (see the section below: Government of Canada Income Tax Resources). Many settlement agencies can help you complete your taxes for the first time. This is just one of many important services that settlement agencies provide.

As we approach the “tax season” in Canada and the deadline to file your income tax return, this information will help you get started.

Navigating the Canadian tax system will make your life here much easier. If you’re already employed, you know that a good portion of your earnings goes to taxes, maybe more than what you were used to in your native country.

The taxes you pay come back to you through helpful public services and many gratuities making Canada one of the most sought-after destinations for immigrants. In addition, you can recover part of your taxes and access tax credits when you file an income tax return each year.

Tax credits are sums that are deducted from the total taxes you owe. You may be eligible for one or more tax credits. When you claim deductions, you may receive a larger refund or reduce the taxes that you owe. Here are some examples of tax credits and deductions that you could be eligible for:

When you claim certain tax credits, you must support your claim with receipts.

When you file your income tax return, you can apply for benefits. These benefits are payments for specific expenses that can help make living in Canada more affordable. Some examples of benefits include:

Here are some benefits you may be eligible for:

| BENEFIT | MARRIED OR COMMON-LAW WITH CHILDREN | MARRIED OR COMMON-LAW WITH NO CHILDREN | SINGLE WITH CHILDREN | SINGLE AND 19 OR OLDER WITH NO CHILDREN |

|---|---|---|---|---|

| Canada Child Benefit | Yes | No | Yes | No |

| GST/HST Benefit | Yes | Yes | Yes | Yes |

| Provincial & Territorial Benefits & Credits | Yes | Yes | Yes | Yes |

Buying a home in Canada is a common goal for many newcomers. However, saving money for a down payment is challenging given the rising housing costs. A First Home Savings Account is a registered plan that helps you save to buy your first home. The FHSA allows your contributions to grow tax-free and helps you prepare to buy your first home. Your FHSA contributions are tax deductible. And the contributions are non-taxable as long as you withdraw the money to buy your first home.

The TFSA allows first-time homebuyers to save up to $8,000 per year with a lifetime limit of $40,000.

If you opened a TFSA in 2023, you can claim up to $8,000 in contributions made by December 31, 2023, as a deduction on your 2023 income tax and benefit return.

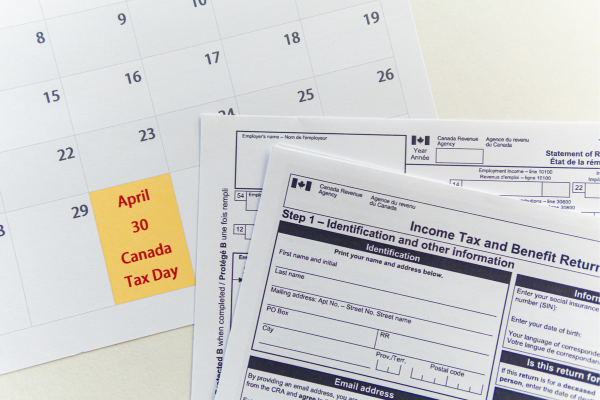

The deadline to file your 2023 income tax return in Canada is on or before Tuesday, April 30, 2024. If you owe taxes, you have to pay the full amount on or before April 30, 2024. If you are self-employed, the deadline to file your income tax return is June 17, 2024. But if you owe taxes, you still have to pay by April 30, 2024.

If you owe money and do not pay by April 30, 2024, you will have to pay daily interest on the amount that you owe. And penalties and interest can become expensive. It’s best to pay the full amount to avoid paying interest and late fees.

You can file your income tax return for 2023 online in two ways:

| EFILE | NETFILE |

|---|---|

| – EFILE is a secure CRA service that lets authorized service providers complete and file your return electronically. | – This electronic tax-filing service lets you do your personal income tax and benefit return online using certified tax preparation software and submit it directly to the CRA. |

You can also complete your income tax and benefit return by paper. Click here to get a 2023 T1 (personal) income tax package. Be sure to order the package for the province that you reside in because the tax system can vary by province.

Here are some free tax software products that you can use. These are great if you have a simple tax return to file:

| Wealthsimple Tax | TurboTax | CloudTax |

|---|---|---|

| – Free autofill tax software allows you to complete a simple tax return – Provides a helpful guide to claiming deductions – Offers paid plans for different tax needs. | – Offers free & paid tax returns – Free tax return service applies to simple tax returns but does not include income, credits, and deductions such as: – Employment expenses (meals, lodging, etc) – Donations -Medical expenses – Investment income and expenses – Rental property income and expenses – Self-employed income and expenses. | – Free and paid services – Offers free ‘how-to’ videos and a step-by-step guided application. |

For more listings, check out this list of free tax software products here.

You may be eligible to use the Community Volunteer Income Tax Program if you have a modest income and a simple tax situation.

Unfortunately, scammers try to get Canadians to pay debts they do not owe. And tax season is a prime time for scammers. Newcomers can be vulnerable to these scams, especially when it comes to receiving a call or letter from a government agency demanding money for payment. However, you can protect yourself if you know when and how the CRA may contact you.

Click here to learn about scam protection and the CRA to protect yourself from fraud. This information will help you to respond if you get an email, phone call, letter, or text from the CRA that seems suspicious.

| RESOURCES | DESCRIPTION |

|---|---|

| Newcomers to Canada | Did you leave another country to settle in Canada in 2023? This information will help you understand the Canadian tax system and what you require to complete your first income tax and benefit return as a resident of Canada. |

| Newcomers to Canada (immigrants & returning residents) | This site will help you to complete your first income tax and benefit return as a resident of Canada. The information is only for the first tax year that you became a new resident of Canada. |

| Get Ready to Do Your Taxes | Get a quick overview of the documents you need to file your income tax return. |

| Don’t Get Scammed! | Learn when and how the CRA may contact you to avoid being a victim of fraud. |

| Common Tax Terms | Glossary of terms to learn about your taxes. |

Learn about your taxes: This course can help you learn about personal income taxes in Canada. It includes seven online learning modules:

Income tax and benefit amounts will change to offset some of the rising living costs. Again, these are important changes that put additional money in your pocket. Some of the important tax changes for 2024 include:

| FEDERAL TAX RATE FOR 2024 | TAXABLE INCOME THRESHOLD |

|---|---|

| 15% on the portion of taxable income that is: | Less than $55,867 or less, plus |

| 20.5% on the portion of taxable income that is: | Over $55,867 up to $111,733, plus |

| 26% on the portion of taxable income that is: | Over $111,733 up to $173,205, plus |

| 29% on the portion of taxable income that is: | Over $173,205 up to $246,752 plus |

| 33% on the portion taxable income that is: | Over $246,752. |

In summary, if you arrived in 2023 and lived in Canada even for a short period, it’s smart to file your first income tax return. And with the deadline approaching on April 30, 2024, there is still time to file your 2023 income tax return. This will allow you to claim deductions and apply for future tax benefits that will put money in your pocket!

Learn more about banking in Canada, and be on your way to financial security and success! From financial first steps to your earnings in Canada, you can learn more when you visit our banking in Canada resource page.

WRITTEN BY

Corinna Frattini

Senior Editor, Prepare for Canada

Corinna Frattini is the Senior Editor and Content Director for Prepare for Canada. She contributes articles to help newcomers achieve their goals in key areas related to living, working, and settling in Canada. With an extensive background in human resources and leadership development, her articles focus on what Canadian employers seek and how newcomers can continue their careers in Canada.

© Prepare for Canada 2025

How to Negotiate a Salary | A Guide for Newcomers

Pay Deductions in Canada | Your Net Pay & Gross Pay